2024 Form 1040 Schedule Eic

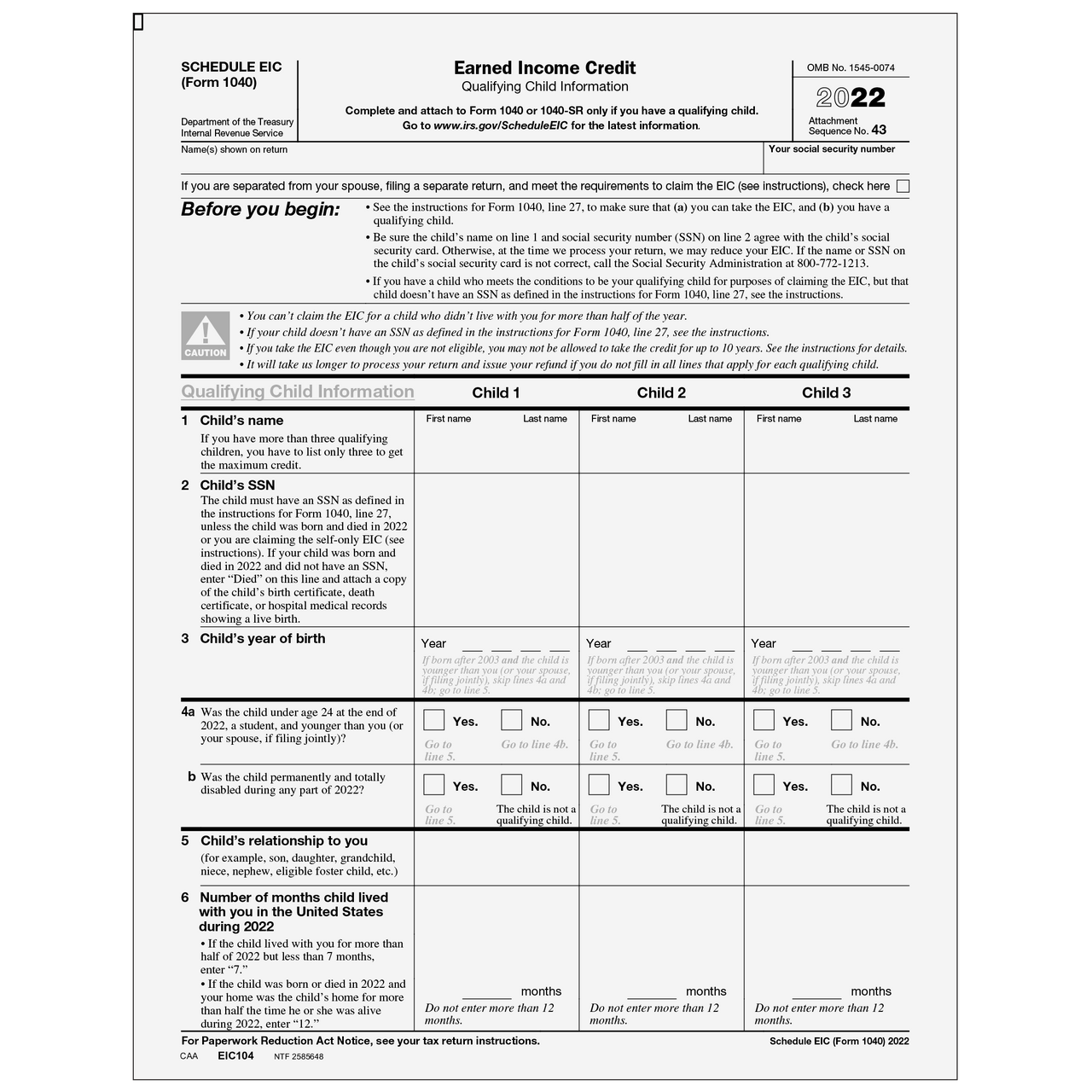

2024 Form 1040 Schedule Eic – To claim the EIC tax credit, taxpayers must file their taxes using Form 1040 or Form 1040-SR and attach Schedule EIC to their return. The credit is refundable, which means that taxpayers can . To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are .

2024 Form 1040 Schedule Eic

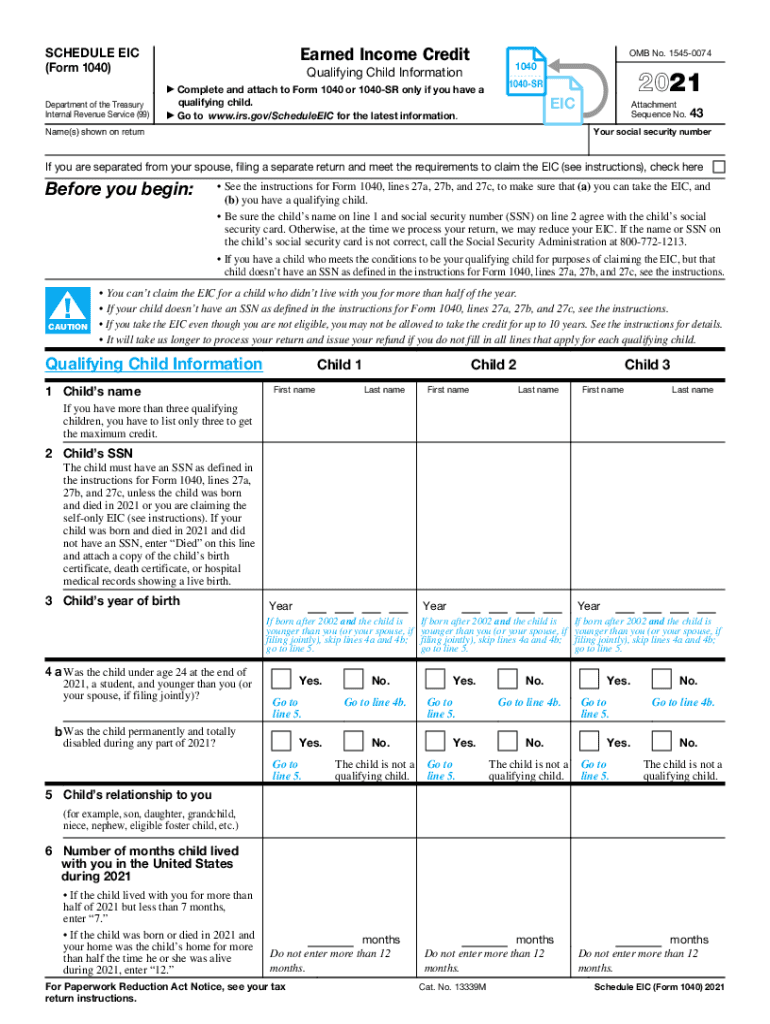

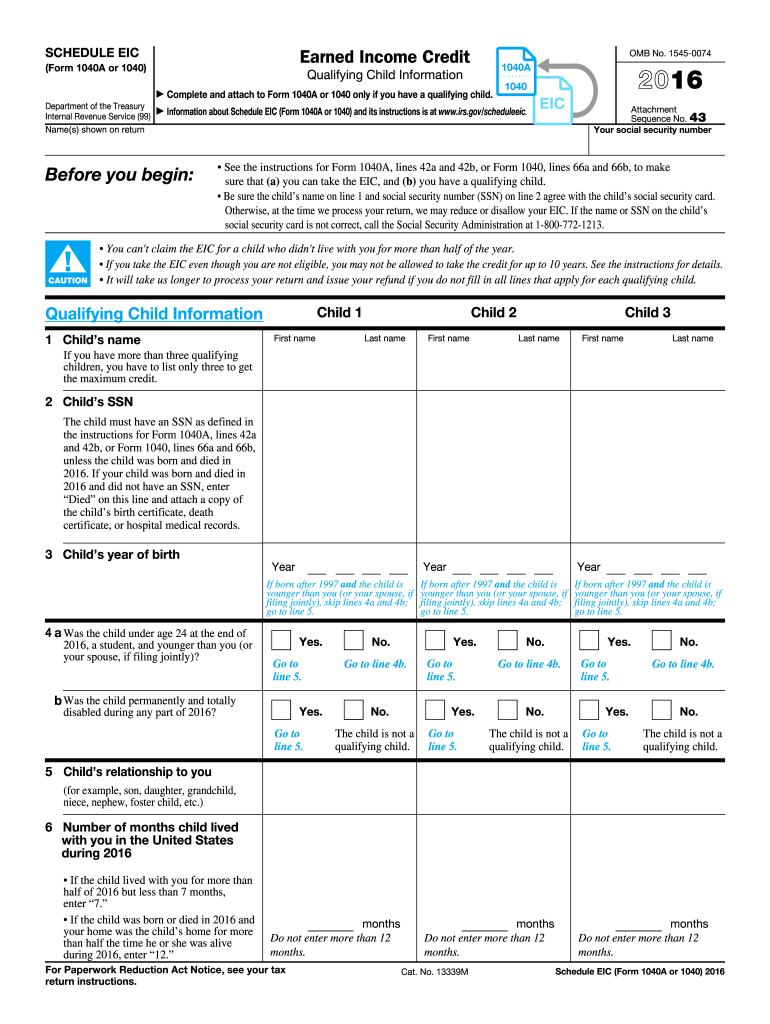

Source : www.nelcosolutions.comIRS Schedule EIC (1040 form) | pdfFiller

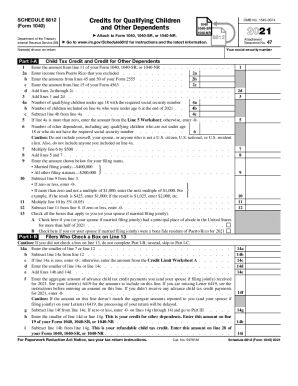

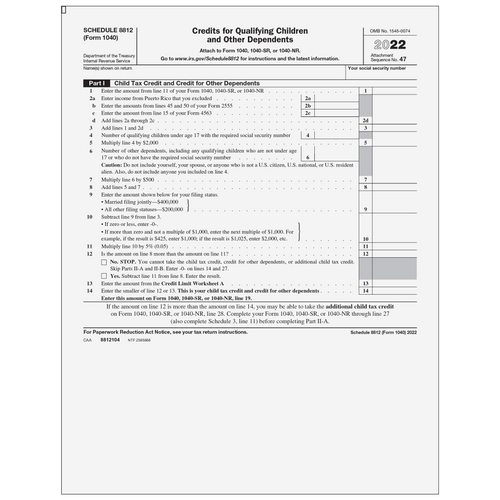

Source : www.pdffiller.com8812 2021 2024 Form Fill Out and Sign Printable PDF Template

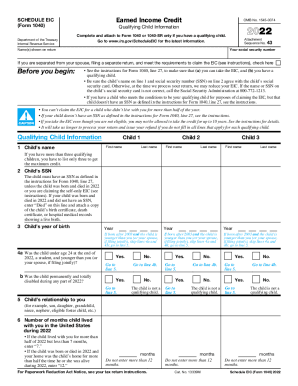

Source : www.signnow.com2023 Form IRS 1040 Schedule EIC Fill Online, Printable, Fillable

Source : eic-form.pdffiller.com8812104 Form 1040 Schedule 8812 Additional Child Tax Credit

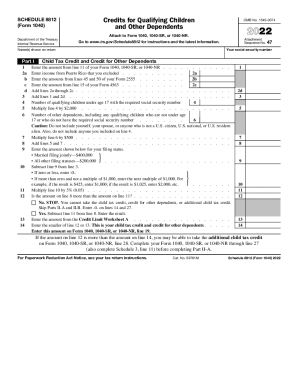

Source : www.greatland.comIRS 1040 Schedule 8812 2022 2024 Fill and Sign Printable

Source : www.uslegalforms.com8812104 Form 1040 Schedule 8812 Additional Child Tax Credit

Source : www.greatland.comSchedule eic: Fill out & sign online | DocHub

Source : www.dochub.comSchedule EIC (Form 1040) | Fill and sign online with Lumin

Source : www.luminpdf.comEitc refund dates: Fill out & sign online | DocHub

Source : www.dochub.com2024 Form 1040 Schedule Eic EIC104 Form 1040 Schedule EIC Earned Income Credit : Make sure you file Schedule EIC (Form 1040) and check the applicable box at the top of the form if you meet the requirements for a separated spouse. You generally must be a U.S. citizen or . Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a .

]]>